Financial Protection

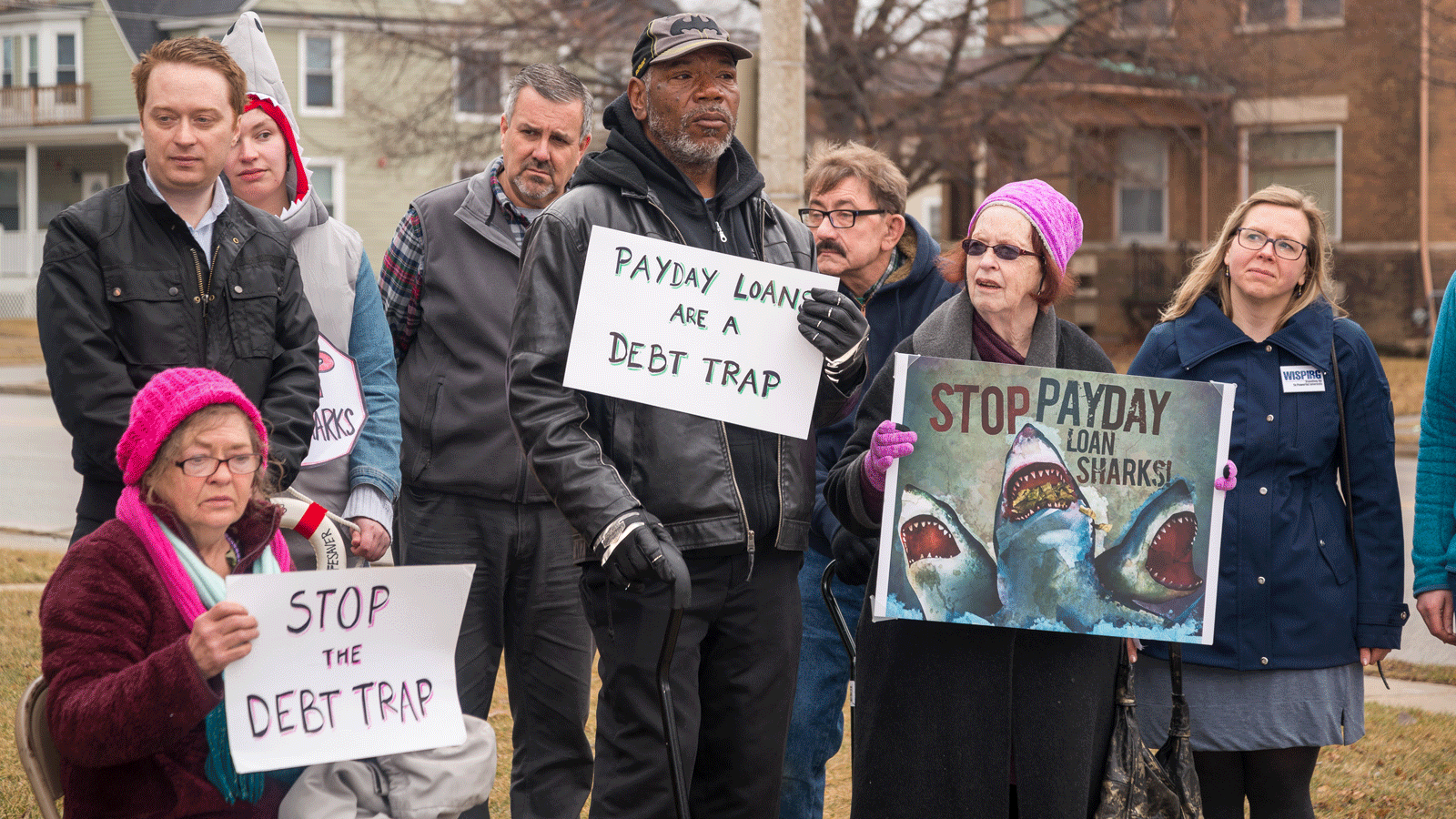

To protect consumers in the financial marketplace, we're working to reform credit bureaus, stop predatory loan sharks, end unfair banking practices and more.

Stop the Debt Trap

Climate Financial Reform

How I got my finances in order

Reports: The CFPB Gets Results for Consumers

Tell insurance CEOs: Stop insuring climate risks

Tell insurance CEOs: Stop insuring climate risks

Updates

“Trigger leads” led to the 2008 housing collapse; industry and consumer groups agree: “not again!”

DIRECT FILE (FREE TAX FILING!) FROM THE IRS OFFICIALLY LAUNCHES TUESDAY, MARCH 12!

Senate hearing on “swipe fees” charged merchants to include airlines: “credit card companies that fly planes”

Congress finally may ban “trigger lists” used by credit bureaus to harass consumers

What You Can Do

Team

Mierzwinski

Ed

Mierzwinski

Senior Director, Federal Consumer Program, PIRG

Litt

Mike

Litt

Director, Consumer Campaign, PIRG

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

FTC goes after second tax prep firm, H&R BLOCK joins INTUIT TURBOTAX for deceptive claims of “Free tax prep”