Poll: Public Wants Federal Agencies to Disclose and Restrict Corporate Tax Write Offs for Out-of-Court Settlements

Washington, D.C. – In recent years, public outrage has built as federal agencies have allowed out-of-court settlements for corporate wrongdoing — like BP’s gulf oil spill and JPMorgan’s toxic mortgages — to be written off for multibillion-dollar tax breaks.

Now, a new poll released today confirms what has long been apparent: The public overwhelmingly disapproves of these write offs, and has a strong preference for federal agencies to be both more transparent and more restrictive of tax deductions for future settlements. Substantial majorities across party lines would support reforms and greater transparency.

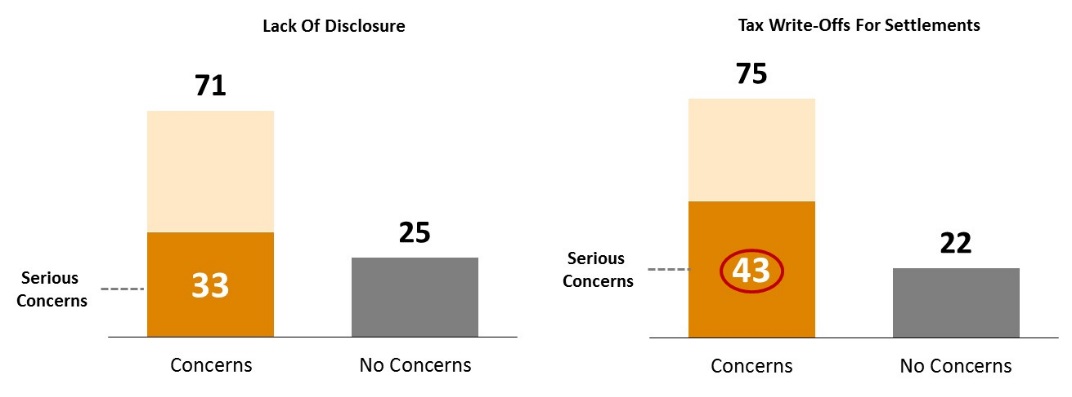

Americans express major concern with the fact that federal agencies are not required to disclose these settlements to the public (71% total concerns, 33% serious concerns) and that corporations are often allowed to write off these financial settlements as tax-deductible business expenses (75% total concerns, 43% serious concerns). The poll was released today by the U.S. Public Interest Research Group Education Fund, and conducted by Lake Research Partners.

“This poll takes a rare look at public attitudes toward agencies making financial deals with corporations charged with violating our country’s laws and regulations. The clear message is that Americans want public disclosure of the deals made in their name, and they don’t want these payments written off as tax deductions,” said Phineas Baxandall, Ph.D., Senior Analyst at the Public Interest Research Group Education Fund.

Americans share these concerns across party lines. High levels of concern about the lack of disclosure requirements for federal agencies were voiced (73% among Democrats, 66% among Independents, and 72% among Republicans. Concern about settlements becoming tax write offs for corporations charged with wrongdoing is even more widely shared (80% among Democrats, 67% among Independents, and 75% among Republicans).

“Giving companies that break the rules and endanger the public a tax break when they get caught is hardly the way to deter bad behavior,” said Gynnie Robnett, coordinator of the Coalition for Sensible Safeguards.

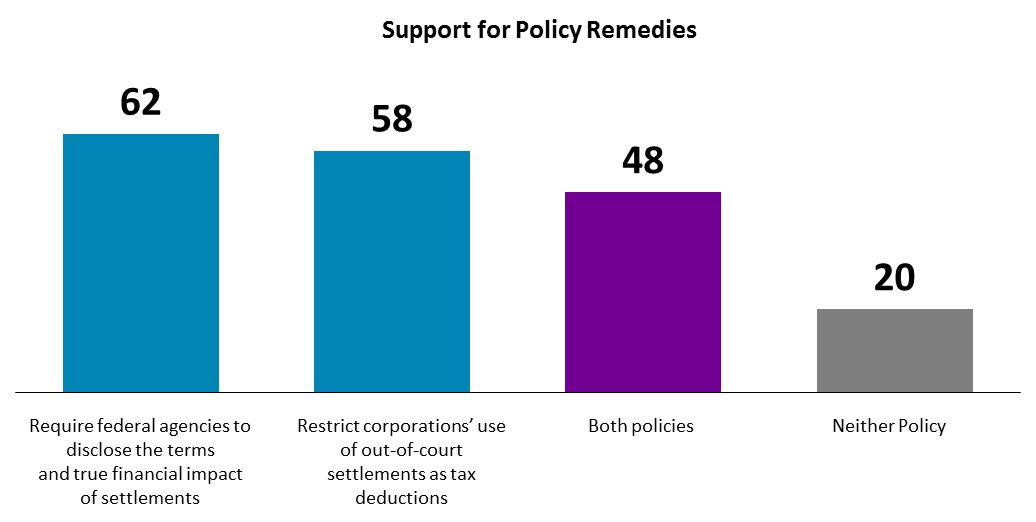

Americans support pursuing remedies over inaction on these issues by roughly a 3 to 1 margin. Almost two-thirds want federal agencies to be required to disclose the terms and true financial impact of settlements (including 68% of Democrats, 57% of Independents, and 63% of Republicans). A strong majority (58%) supports restrictions on corporations using out-of-court settlements as tax deductions.

“Americans want corporations that break the rules held accountable, just as ordinary citizens must follow the law. There shouldn’t be secret deals to resolve responsibility for public harms such as insider trading, Medicare fraud or selling dangerous products. And the public doesn’t want corporations to treat payments for these actions as a tax deduction,” said Baxandall.

The law forbids fines or penalties to be treated as tax deductions, but no such rule exists for financial settlements made in lieu of such payments. IRS and GAO studies indicate that the Treasury loses billions of dollars each year as a result of this loophole unless agencies specifically forbid tax deductibility of their settlements. Federal agencies have little incentive to disclose when the true value of settlements they announce are diminished by tax write offs or special credits.

“There are a couple things that federal agencies can do right away to reflect these views of the American public. Agencies like the Department of Justice can start disclosing all their settlements online, and make clear whether these deals can be deducted, or whether totals include ‘credits’ for other activities or past settlements,” said Baxandall. “To protect other taxpayers and improve their own future bargaining position, agencies should establish clear policies restricting settlement payments from being deducted.”

Lake Research Partners designed the survey, which was administered March 20-23, 2014 as part of the ORC International CARAVAN omnibus survey of 1,005 adults living in the continental United States. The survey has a margin of error of +/- 3.1%.

You can read U.S. PIRG’s research report on the tax implications of legal settlements, “Subsidizing Bad Behavior: How Corporate Legal Settlements for Harming the Public Become Lucrative Tax Write-Offs.

U.S. PIRG has created a general fact sheet on the settlement loophole, and separate factsheets related to: Wall Street scandals, consumer rip offs, and health care scams.