PIRG Delivers 12,600 Petition Signatures & Letter against the Bank Lobbyist Act before Today’s Vote in the House

Today, we sent a letter to all members of the House of Representatives in opposition to S.2155, which is expected to come up for a vote this afternoon. This bill, which we call the Bank Lobbyist Act, is the biggest roll-back of Wall Street Reform protections for mortgage borrowers and our economy since the economic crash 10 years ago. It also provides breaks for Equifax and the other national credit bureaus. In addition to our letter, we also delivered petition signatures from over 12,600 of our members across the country in opposition to S. 2155's credit bureau related problems.

Today, we’re sending a letter to all members of the House of Representatives in opposition to S.2155, which is expected to come up for a vote this afternoon – this bill, which we call the Bank Lobbyist Act, is the biggest roll-back of Wall Street Reform protections for mortgage borrowers and our economy since the economic crash 10 years ago. It also provides breaks for Equifax and the other national credit bureaus.

In addition to our letter, we’re delivering petition signatures from over 12,600 of our members across the country, in opposition to S. 2155’s credit bureau related problems.

The start of our letter:

Dear Representative,

On behalf of U.S. PIRG and its member non-partisan state Public Interest Research Groups, we write to urge you to oppose S2155, the so-called “Economic Growth, Regulatory Relief, and Consumer Protection Act.” While we appreciate the Senate Banking Committee’s original intent to craft a narrow bill to help only community banks and credit unions, we cannot support S2155 as passed by the Senate and under House consideration this week (with no amendments made in order).

S2155 will increase mortgage fraud and racial discrimination; it will also increase risky banking practices by the nation’s biggest banks, less than years after the September 2008 financial system collapse and October bank bailout. To call it a bill for community banks and credit unions is wrong.

We also link to an additional group letter detailing why the bill’s numerous giveaways to the mistaken-ridden credit bureaus – claimed by the bill’s proponents as supposed pro-consumer amendments – are actually enough reason on their own to oppose S2155.

Our full letter is here.

Topics

Authors

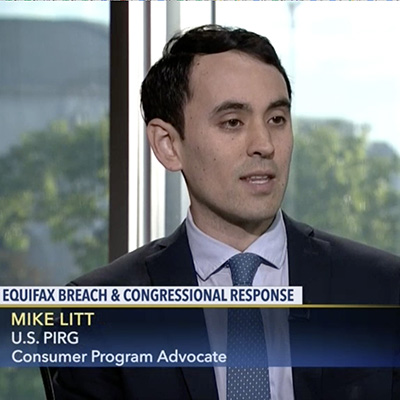

Mike Litt

Director, Consumer Campaign, PIRG

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

FTC goes after second tax prep firm, H&R BLOCK joins INTUIT TURBOTAX for deceptive claims of “Free tax prep”