Six Months Out From Equifax Hack, Are Consumers Any Better Protected?

Consumers agree: Equifax must be held accountable for its wrongdoing. Yet the Trump administration and Congress still haven’t taken action to do that, or to better protect consumers from identity theft in the future. What are they waiting for?

Credit: dennizn/Shutterstock

We live in the age of big data, where more and more information about the private details of our lives is collected, analyzed and sold by massive financial institutions. Too often, this information is handled irresponsibly, or put at risk without our consent or control.

March 7, 2018 marks six months from the day credit reporting agency Equifax announced it had been breached, resulting in the loss of more than 147 million Americans’ personal information.

The breach was unprecedented in terms of the types of information stolen—data ranging from Social Security numbers to driver’s license details—and we’ll likely be experiencing the fallout from the event for years to come. Just last week, Equifax reported the loss of information for an additional 2.4 million consumers.

Consumers agree: Equifax must be held accountable for its wrongdoing. Yet the Trump administration and Congress still haven’t taken action to do that, or to better protect consumers from identity theft in the future. What are they waiting for?

We’ve been building public support and advocating on Capitol Hill for Congress to pass several pieces of important federal legislation that would give consumers more control over their financial information, and help prevent Equifax-like breaches in the future. These include:

-

the Data Breach Prevention and Compensation Act, which would hold big credit bureaus accountable when they fail to protect our information;

-

the Control Your Personal Credit Information Act, which would give consumers greater control over when and how their consumer reports are shared by consumer reporting agencies; and

-

the Freedom From Equifax Exploitation (FREE) Act, which would give all Americans the ability to freeze and unfreeze their credit at the three major credit bureaus at no cost.

These bills would greatly improve consumer protections related to data security and identity theft, but Congress has yet to move on them. Instead, lawmakers are considering three bills this week that would let Equifax and the other credit bureaus off the hook for data breaches and credit freezes.

Why isn’t Congress voting on or having hearings about bills that would help prevent future data breaches, or better inform consumers when there are breaches, or give complete control back to us over our own information?

Instead of moving on legislation that would let Equifax off the hook, Congress should follow the lead of states that are giving consumers more control over their financial information. Staff in our national network are working on free credit freeze bills in several states, including Massachusetts, Illinois, Washington and California, and working in others to improve existing credit freeze laws.

In most states, you currently have to pay fees to freeze your credit. U.S. PIRG opposes these fees because consumers shouldn’t have to pay to protect themselves from a problem they didn’t create. A credit freeze with all three major credit bureaus remains the best action consumers can take after the Equifax hack, whether they were affected or not.

The Equifax breach was a wake-up call that made clear the unsightly reality of our modern financial system, and we must use this opportunity to show Equifax and other large financial companies that there are repercussions when they put consumers at risk of wrongdoing.

Whether it’s on Capitol Hill or in state capitols, our national network of advocates, organizers, researchers and communicators won’t let up until consumers have strong protections against identity theft in place, and Equifax is held fully responsible for losing our information.

Topics

Authors

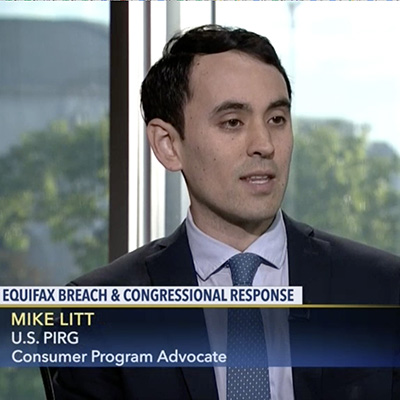

Mike Litt

Director, Consumer Campaign, PIRG

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

FTC goes after second tax prep firm, H&R BLOCK joins INTUIT TURBOTAX for deceptive claims of “Free tax prep”