Consumer Complaints Break Records

CFPB Must Take Powerful Action To Protect Consumers In Pandemic

On the 10th anniversary of the Consumer Financial Protection Bureau’s (CFPB) establishment as a centerpiece of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the law passed on 21 July 2010 and the Bureau opened its doors one year later), we look at the latest results from the CFPB’s public Consumer Complaint Database. This snapshot finds that, as the COVID-19 pandemic wreaks havoc on the financial situations of millions of Americans, consumer complaints to the CFPB have spiked to record levels. The CFPB must take powerful action to protect consumers in the financial marketplace.

Downloads

On the 10th anniversary of the Consumer Financial Protection Bureau’s (CFPB) establishment as a centerpiece of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the law passed on 21 July 2010 and the Bureau opened its doors one year later), we look at the latest results from the CFPB’s public Consumer Complaint Database.[1] The complaint database is a jewel of the CFPB’s available tools to make financial markets work better.

Despite a long-running campaign by CFPB opponents to eliminate the public consumer complaint database, it has survived the change in administrations. In September 2019, CFPB Director Kathy Kraninger announced that the CFPB database would remain public.[2]

By law,[3] two primary missions of the CFPB are providing consumers with “timely and understandable information to make responsible decisions about financial transactions,” and ensuring that “markets for consumer financial products and services operate transparently and efficiently to facilitate access and innovation.” The CFPB’s public Consumer Complaint Database helps accomplish both missions.

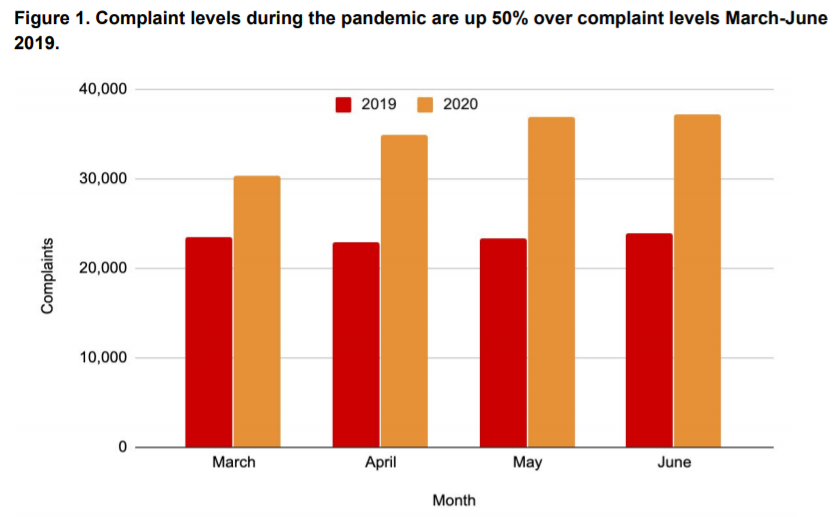

This snapshot finds that, as the COVID-19 pandemic wreaks havoc on the financial situations of millions of Americans, consumer complaints to the CFPB have spiked to record levels. We note that the CFPB has reported similar results during this time of unprecedented financial uncertainty; the CFPB must take powerful action to protect consumers in the financial marketplace.[4]

Yet, rather than expanding its consumer protection mission, the CFPB has weakened consumer protections since the start of the pandemic. On 7 July, it weakened protections against predatory payday lenders.[5] The CFPB also issued recent guidances to firms, including consumer reporting agencies, that it will not enforce certain consumer law violations during the pandemic.[6] Further, the CFPB rejected consumer organization requests to halt all regulatory actions not related to helping consumers during the pandemic, including to halt the work of a deregulatory “Task Force on Federal Consumer Law.” In response, groups including our sister organization U.S. PIRG sued the CFPB over the illegal establishment and structure of that Task Force.[7]

Footnotes

[1] Access the database at https://www.consumerfinance.gov/data-research/consumer-complaints/

[2] U.S. PIRG Release, “Good news for consumers: A big database of consumer complaints will stay public,” 3 October 2019, available at https://uspirg.org/blogs/news-briefs/usp/good-news-consumers-big-database-consumer-complaints-will-stay-public

[3] CFPB’s “Purpose, objectives and functions,” available at https://uscode.house.gov/view.xhtml?req=(title:12%20section:5511%20edition:prelim)

[4] CFPB Presentation, “Joint Advisory Committee Meeting Presentations,” 1 May 2020, available at https://files.consumerfinance.gov/f/documents/cfpb_presentations_combined-advisory-committee-meeting_2020-05.pdf

[5] U.S. PIRG Release, “CFPB Greenlights Predatory Payday Loans Amid COVID-19 Pandemic,” 7 July 2020, available at https://uspirg.org/news/usp/cfpb-green-lights-predatory-payday-loans-amid-covid-19-pandemic; CFPB Release, “CFPB Issues Final Rule On Small Dollar Lending,” 7 July 2020, available at https://www.consumerfinance.gov/about-us/newsroom/cfpb-issues-final-rule-small-dollar-lending/

[6] CFPB Release, “CFPB Issues Credit Reporting Guidance During COVID-19 Pandemic,” 1 April 2020, available at https://www.consumerfinance.gov/about-us/newsroom/cfpb-issues-credit-reporting-guidance-during-covid-19-pandemic/

[7] U.S. PIRG Release, “Consumer Advocates Sue CFPB For Granting Financial Services Industry Illegal Influence Over Consumer Protection Policy,” 16 June 2020, available at https://uspirg.org/news/usp/consumer-advocates-sue-cfpb-granting-financial-services-industry-illegal-influence-over

Topics

Find Out More

Is Alexa always listening? How to protect your data from Amazon

Safe At Home in 2024?